Unlocking Africa's Financial Future: From Cash Kings to Digital Innovations

In 2017, World Bank figures revealed that just under 43% of sub-Saharan Africans over 15 years old possessed a bank account, lagging behind other regions.

In 2017, World Bank figures revealed that just under 43% of sub-Saharan Africans over 15 years old possessed a bank account, lagging behind other regions. This statistic paints a vivid picture of the enormous potential for growth in Africa's banking sector. Before the pandemic, McKinsey ranked the continent as the world's second-largest market for growth and profitability, projecting banking revenues to soar to $129 billion by 2023.

Cash Still Rules the Roost in Africa

Despite this potential, cash remains the primary mode of transaction across the continent. In Nigeria, where 99% of transactions are in cash, and even in South Africa, with a relatively high banking penetration of 90-95%, cash remains the preferred choice. This preference for cash is driven by factors such as low digital payment penetration, perceived high fees on digital platforms, the convenience and safety of cash, the prevalence of cash in informal sectors, and limited accessibility to digital payment methods due to underdeveloped systems and technological barriers.

Telcos and Fintechs: The Rise of Digital Giants

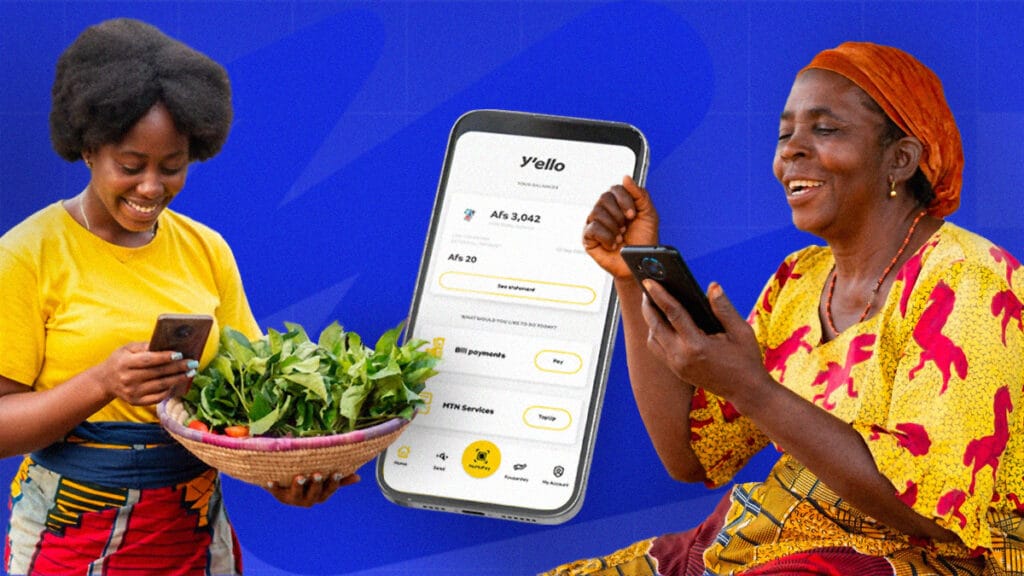

Telcos Stepping into Banking

The proliferation of mobile phones in Africa, surpassing access to traditional banks, presents a unique opportunity. With smartphone subscriptions in Sub-Saharan Africa projected to reach 689 million by 2028, telcos are positioned to bridge the banking gap. By 2022, sub-Saharan Africa boasted 469 million mobile money accounts, a testament to telcos' potential to revolutionize banking.

E-Payments on the Rise

E-payments in Africa have been gaining momentum, especially during the COVID-19 pandemic. While cash still dominates, McKinsey predicts a shift as e-payments gain momentum, projecting Africa's domestic e-payments market to reach $40 billion by 2025. This growth is fueled by innovation, reducing friction in payments and offering new solutions to consumers and businesses.

Challenges for Telcos

Despite their potential, mobile operators face challenges in overtaking traditional lenders. Regulatory concerns, the reluctance of informal businesses to accept digital payments, and the broader service offerings of banks pose hurdles for telcos. Banks can provide a broader range of services, fewer restrictions on transactions, and leverage existing relationships.

The Competitive Landscape: Telcos vs. Traditional Banks

Telecom companies have emerged as formidable players in Africa's banking sector, leveraging their vast networks and customer bases. This trend is seen as a threat to traditional banks, as telecom companies offer a range of financial services and build extensive agent networks in rural areas. The growth of mobile phone use and the lower cost of communication have propelled telecom companies to challenge the dominance of traditional banks.

Untapped Potential: Africa's Digital Payments Landscape

The digital payments landscape in Africa has seen explosive growth, with numerous fintech start-ups securing funding. In 2021 alone, nearly 250 fintech start-ups received funding, up from 38 in 2019. While significant gaps remain in the market, the opportunities for growth are immense, with various players addressing customer challenges.

The Outlook for Africa's Digital Payments

The growth of digital payments in Africa will be uneven, dependent on factors such as infrastructure readiness, e-commerce penetration, mobile-money penetration, and regulatory frameworks. Countries like Egypt, Ghana, Kenya, Nigeria, and South Africa are leading the transition to digital, with Nigeria projected to experience the fastest growth at 35% per year. Other countries, including Ghana, Ivory Coast, Kenya, Senegal, and Uganda, will also witness robust growth. South Africa is expected to remain the largest e-payments market in Africa by 2025, with $5 billion in annual revenues.

In essence, Africa stands at the precipice of a financial revolution, with the potential to transform its banking landscape and bring financial inclusion to the forefront. As telcos and fintechs continue to innovate and address existing challenges, the continent is poised for a digital payments revolution, unlocking new opportunities for growth and prosperity.